APRA’s latest data: Advised clients still come out on top

APRA’s claims and disputes statistics for life insurers as at December 2022 revealed that claims admittance rates were higher for advised-clients as compared to non-advised individuals.

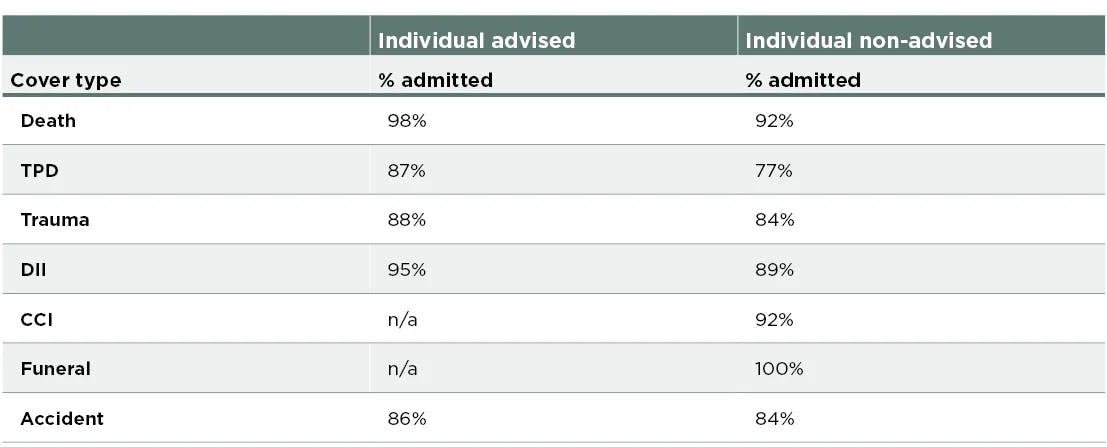

Looking at the key insurance product categories, 98 per cent of death claims for advised individuals were admitted, versus 92 per cent for non-advised. For Total and Permanent Disability cover, 87 per cent of advised claims were admitted versus 77 per cent for non-advised individuals’ claims.

Similarly, 88 per cent of trauma claims were admitted for advised individuals, compared to 84 per cent for their non-advised counterpart. 95 per cent of Income Protection claims for advised individuals were admitted versus 89 per cent for non-advised claims.

Claims admittance rates to December 2022 by cover type and distribution channel. Source: APRA

“Generally, individual advised business shows higher admittance rates than individual non-advised for the same cover type”, APRA said.

The regulator suggested this could be because advisers gave their clients clear expectations of what was covered in their policy and guidance around whether a claim would be successful before it was made.

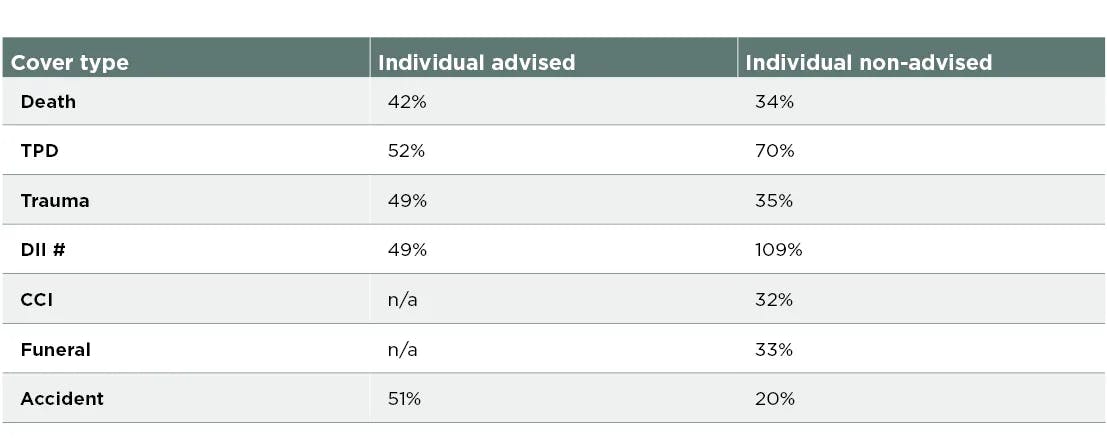

The claims paid ratio (which represents the dollar value of claims paid out versus total premiums paid) appeared to be more of a mixed picture, with individual advised products having a higher ratio of 42 per cent for death cover, versus 34 per cent for non-advised death cover.

Claims paid ratio to December 2022 by cover type and distribution channel. Source: APRA

Advised trauma products also had a higher claims paid ratio of 49 per cent, compared to 35 per cent for non-advised trauma products.

Similarly, several categories of advised insurance products had lower dispute lodgement ratios (i.e., the number of disputes lodged per 100,000 lives insured across the product category).

Death cover had a ratio of 12 for advised products versus 30 for non-advised products, while Income Protection cover had a ratio of 302 for advised products versus 407 for non-advised products.

The data follows similar statistics from APRA which have previously illustrated the potential advantages for advised life insurance clients when making a claim.

Life insurer profitability

Industry performance statistics from the prudential regulator revealed a mixed result for life insurers last year, with product performance improving but investment losses ballooning as interest rates rose during 2022.

According to APRA’s life insurance statistics for December 2022, risk products recorded a net profit after tax of $1.1 billion for the 2022 calendar year, compared to $745.6 million the previous year. This represented the best result for risk products in five years, which can primarily be attributed to better performance in individual disability income insurance products as a result of repricing stemming from APRA’s restrictions, as well as movements in bond yields.

Individual lump sum products did not perform as well, recording a loss of $329.2 million for the year which was due to an increase in net policy expenses.

Expenses across the industry as a whole declined in 2022, with operating expenses decreasing by 8.5 per cent year on year – continuing a five-year trend of declining expenses among life insurers, with total expenses declining by 45.6 per cent.

However, net policy expenses increased by 10 per cent in the last quarter of 2022, while operating expenses increased by 15 per cent in the December quarter compared to the September quarter. Total expenses rose by 37.9 per cent from the September to the December quarter of 2022.

Insurers reported an overall net profit after tax of $0.5 billion for the year to December 2022 and a return on assets of 1.8 per cent, which was a significant decrease compared to the previous year’s results of $1.2 billion with a 4.4 per cent return. This was due to investment losses of more than $6 billion on interest bearing investments, APRA said, which represented the worst investment performance for insurers over the past five years.

This information is for advisers only.

This information is for advisers only and is general in nature, it does not take into account your objectives, financial situation or needs. Before determining whether to apply for or hold the product(s) you should read the Product Disclosure Statement (PDS) and consider the appropriateness of the product(s) to your circumstances. A copy of the PDS can be obtained from 132 977 or on our website clearview.com.au/pds. If relevant, information about the Target Market Determination(s) for this product(s) is available at clearview.com.au/tmd. ClearView does not make any representation as to the accuracy of any referenced websites or articles, and to the extent permitted by law, does not accept any responsibility or liability for the content.

You might also be interested in

12 Mar, 2024

Most injuries happen at home, not work

The latest injury statistics are a stark reminder that accidents can happen anywhere, but are less likely to happen at work, making it critically important to hold comprehensive life insurance incl...Read more